Most Callaway Electric members have a fairly simple rate structure made up of two parts - a service availability charge and a kilowatt-hour (kWh) charge. The member charge is a fixed amount, and the kWh charge varies based on the amount of kilowatt-hours a member uses each month.

The service availability charge helps the cooperative recover a small part of the fixed distribution costs of serving members, including expenses such as administration, operations and maintenance. However, the majority of revenue needed to cover these distribution costs comes from kWhs sold to members.

The cost per kWh is made up of three components - energy (kilowatt-hour), demand (kilowatt) and distribution expenses, shown proportionally in the graph on the right, using an average of 13 cents per kWh.

Net metering is a process that enables Callaway Electric members with a wind or solar system on their home or business to export power that is in excess of their immediate on-site needs.

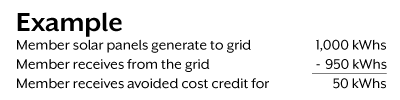

This offsets an equal amount of power supplied by Callaway Electric at a different time within the same billing period. As required by law, Callaway Electric bills the member at the regular retail rate for the 'net' amount of power used that is in excess of power the member generates on site.

If members generate more power than their home uses during their monthly billing period, the excess is metered and put out onto the electric grid. Callaway Electric subtracts the amount of power purchased from the grid from the amount generated out to the grid and provides the member with a 'credit' for the 'net excess' power. Like most Missouri cooperatives, Callaway Electric calculates the credit by multiplying the number of 'net excess' kilowatt-hours times Associated Electric Cooperative's cost to purchase the fuel needed to generate a kilowatt-hour (called avoided cost).

Under current net metering laws, Callaway Electric is not able to recover distribution expenses and demand costs through kilowatt-hour sales when a member installs a solar array or wind turbine. Those costs are then spread to the Callaway Electric membership without solar or wind to maintain vital infrastructure - distribution lines, poles and equipment, along with the transmission network and power plants delivering 24/7 electricity to all members.

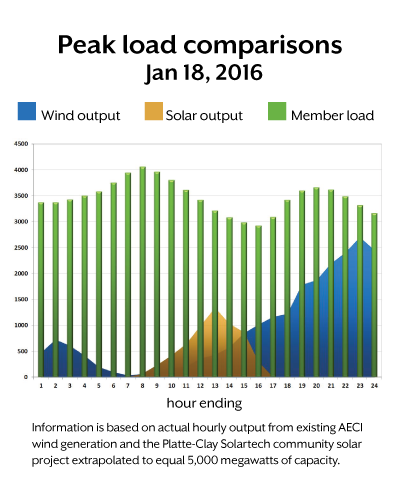

Why are all these resources needed? The energy output from solar or wind does not typically coincide with members' peak load - early in the morning on a cold winter's day. That is why a diverse power supply, including coal and gas, is so important. The chart shown here illustrates that replacing Associated's existing baseload resources with 5,000 megawatts of wind or solar leaves a huge gap between what our members need to power their homes and what wind or solar would provide on a peak winter day.

Renewable interest groups and solar vendors would like to see significant changes to current net metering statutes that would increase subsidies paid by members who don't have wind or solar. Key points of their suggested changes are listed below.

INCREASE SYSTEM SIZE The current law limits net metering to systems of 100 kilowatts or less; these groups would like to increase the size to 500 kilowatts or less. This would allow businesses to put in larger arrays that generate more electricity, reducing the kilowatt-hours they purchase from Callaway Electric. This shifts more costs of maintaining the grid to the rest of the Callaway Electric members.

RETAIL RATE CREDITS FOR NET EXCESS Paying the retail rate for a kilowatt-hour unfairly shirts more costs onto Callaway Electric members who do not have a wind or solar system. It also forces Callaway Electric to pay a higher cost to purchase power than we would incur with our own generators.

ANNUALIZED NET METERING BILLING This has the same effect as paying retail for any net excess. Annualizing the net metering account would carry the monthly net excess forward as kilowatt-hours at a retail rate, not a credit for kilowatt-hours at avoided cost.

STATE INCOME TAX CREDIT Wind and solar are already heavily subsidized with a 30 percent federal income tax credit and current net metering laws. Renewable interest groups encouraged implementing a state tax credit that would mean more subsidies and cause additional burden on Missouri taxpayers, possibly leading to tax increases to comply with the balanced budget requirement.

More Renewable Energy Info

For additional information about renewable energy, be sure to visit the following pages within Callaway Electric Cooperative's website. Keep in mind, we are here to help. Please don't hesitate to reach out.